Out Of This World Info About How To Become A Licensed Tax Preparer

California law requires anyone who is physically in california and prepares (or assists with) tax returns for a fee, and is not an attorney, certified public accountant (cpa) or.

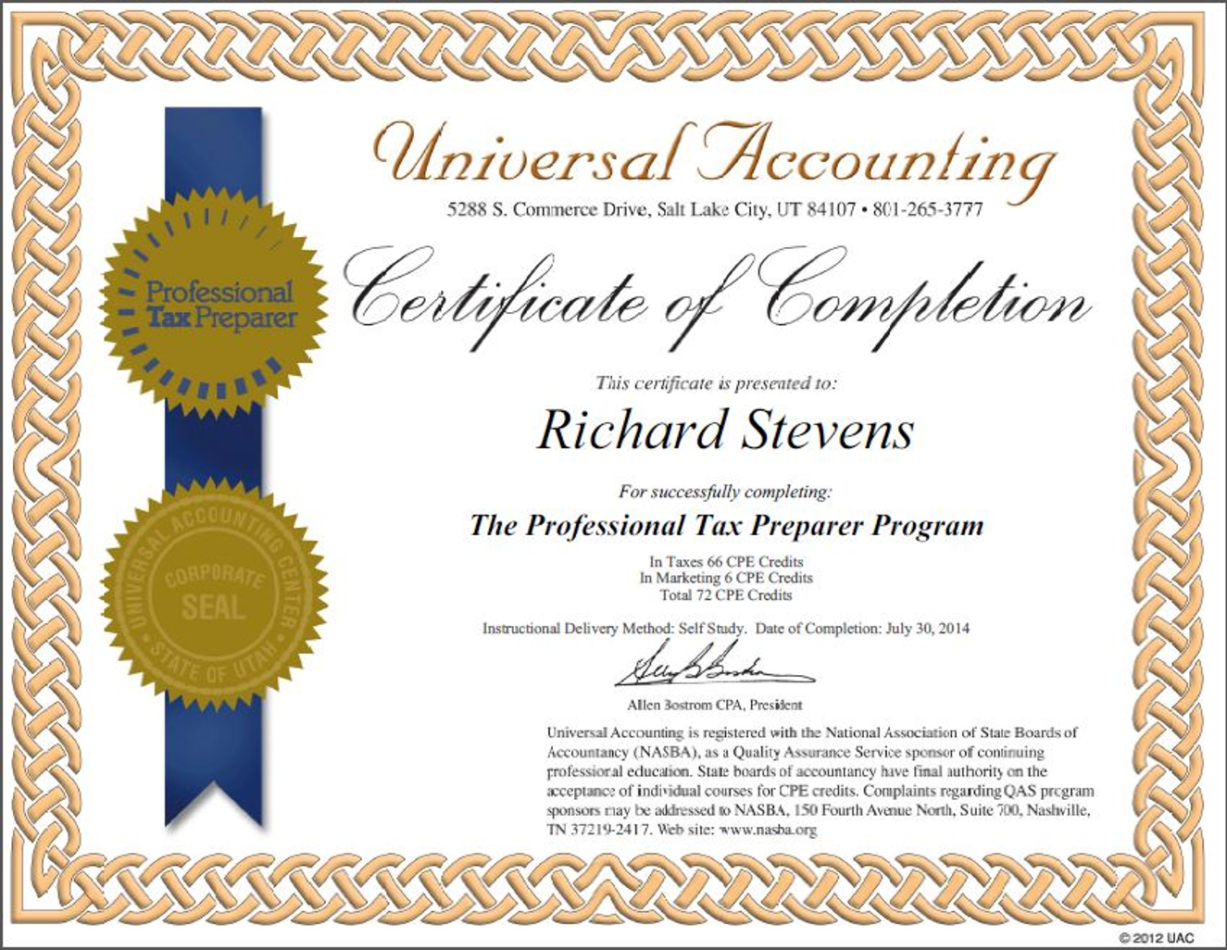

How to become a licensed tax preparer. The first step to becoming a tax preparer, the first step is to apply for a preparer tax identification number (ptin). How to become a professional tax preparer: Obtain a preparer tax identification number (ptin).

You must complete a minimum. You can apply for your ptin on the irs website. You need to have a preparer tax identification number or ptin through the irs to become a tax preparer.

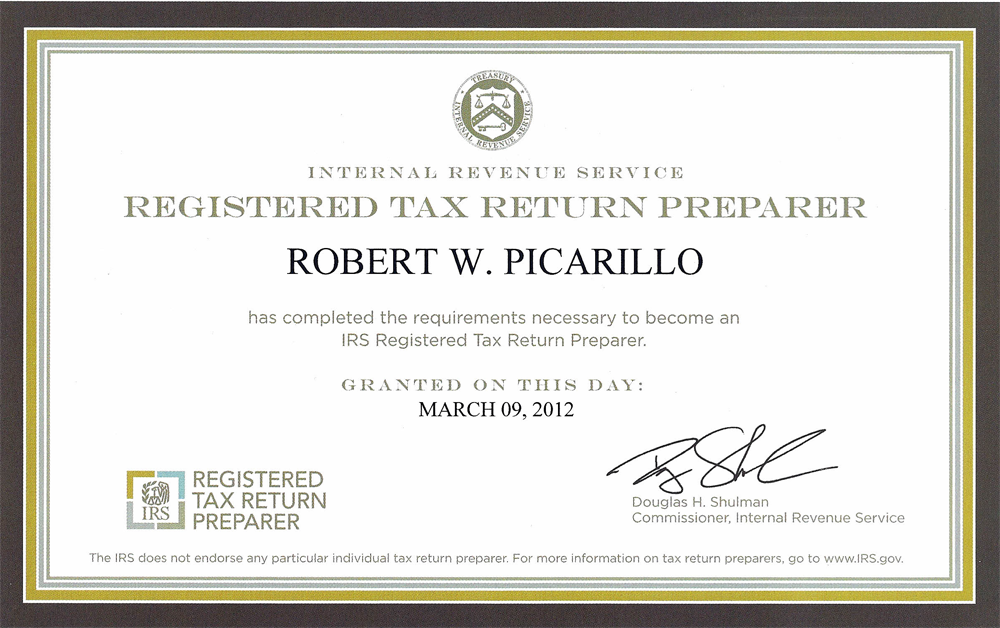

A tax preparer (or service provider) is a third party who, by agreement, files electronic tax transactions, either in bulk or single entry online, on behalf of. An enrolled agent is a registered tax return preparer required to pass a suitability check, take an extensive test covering individual and business taxes as well as representation issues, and. You must be a high school graduate or have passed an equivalency examination.

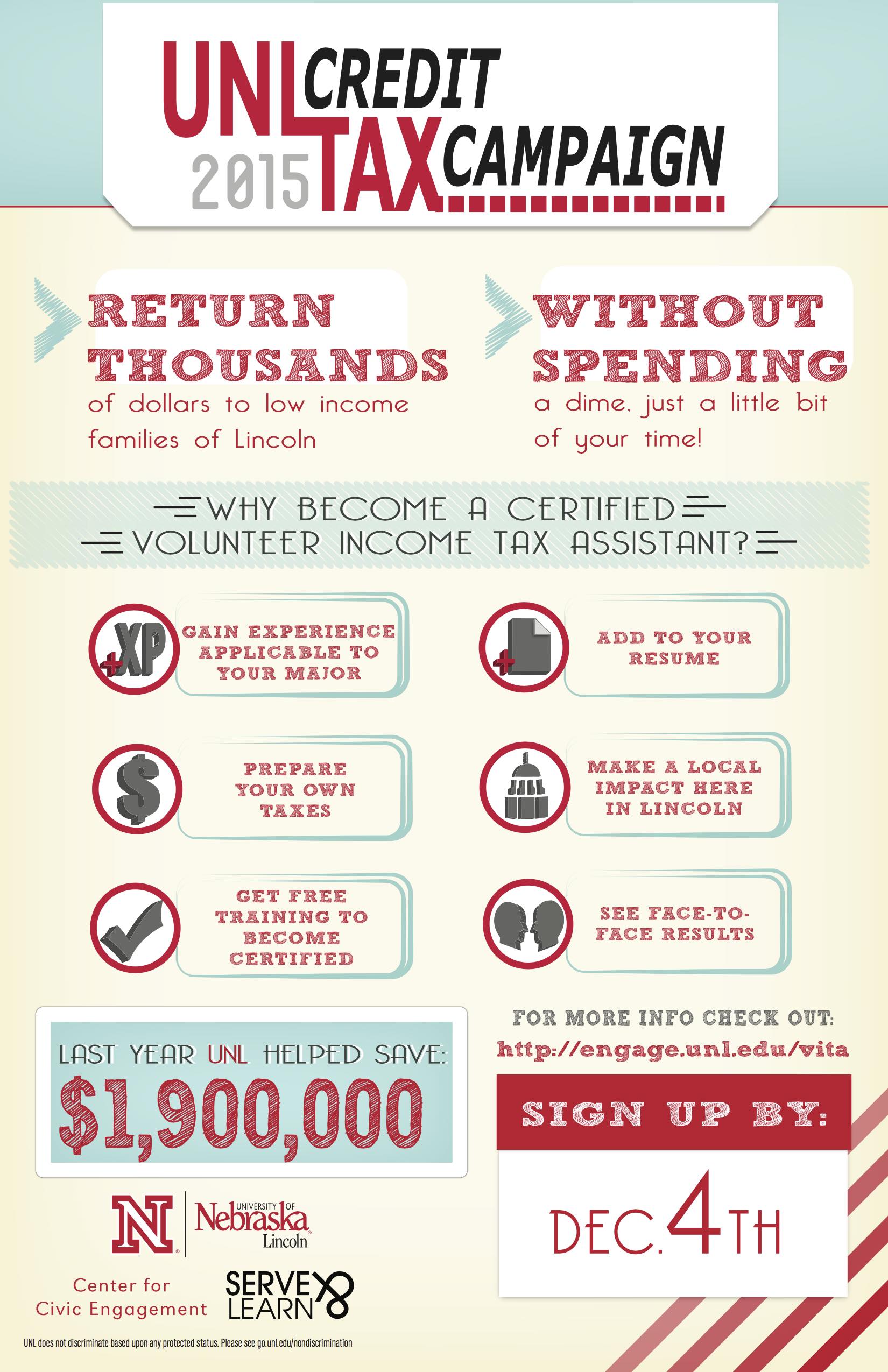

To become a ctec registered tax preparer,. For example, an electrician must complete three or four years. Obtain a preparer tax identification number (ptin) from the irs, and pay a $33 registration fee you must also complete 20 hours of continuing tax professional education each year.

Create your ptin anyone who prepares tax returns and charges a fee for their services is required to have a preparer tax identification number. To become a licensed tax preparer you must be at least 18 years of age. The ptin is the starting point.

To do so, fill out an application and include personal information, such. Visit prometric’s special enrollment examination (see) webpage to schedule your test. Steps to becoming an enrolled agent:

.jpg?v=637860662400000000)